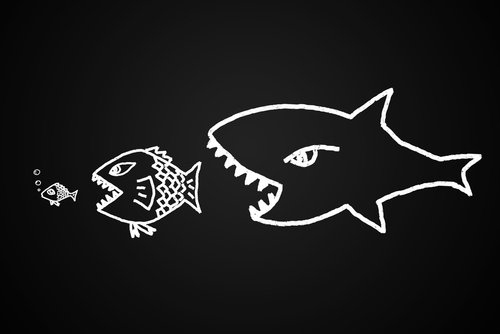

In the last 18 months, there has been significant merger and acquisition activity in the HCM space. That part is not a secret. What might be more of a mystery is why we view merger and acquisition activity in general much differently than an industry analyst or investor would.

In the last 18 months, there has been significant merger and acquisition activity in the HCM space. That part is not a secret. What might be more of a mystery is why we view merger and acquisition activity in general much differently than an industry analyst or investor would.

In what’s probably a surprise to no one, mergers and acquisitions are rarely done for branding reasons. In the best situations, complementary brands are a happy accident that comes from an acquisition driven by finances, legal wrangling, customer acquisition, or product integration.

For customers and prospects, though, the brands and resulting changes are important. A few issues that come up during the merger and acquisition process that can drive perception changes in the market include:

- Brand misalignment — When two companies with very different brands merge, everyone wonders which one will come out on top. When Sprint merged with Nextel, Sprint was seen as plodding, Nextel as agile.

- Brand baggage — When one company brings some seriously bad brand juju to the table, it can impact the resulting acquisition. If your organization is willing to partner with a company with that bad of a brand, your customers and prospects can question their own perceptions.

- Merger success — A brand can be burnished — or tarnished — by how successful the merger is deemed. When AOL bought Time Warner, the deal ended up stinking for everyone, and it impacted the brand.

Mergers and acquisitions have a huge impact on the resulting brand and make an already volatile situation even more difficult to manage.