You’ve probably heard of SPACs by now, right? If not, you will hear much more soon. These Special Purpose Acquisition Companies are the hottest thing on Wall Street, and they’re invading Work Tech.

These entities are so-called blank-check companies that are an alternative to traditional IPOs for financing. Essentially, investors give money to a sponsor, like a hedge fund, so that they can invest in a lucrative opportunity, but more or less with blind faith. Hence the moniker “blank-check” company. The sponsor takes the company public, bypassing the traditional regulatory hurdles of an IPO.

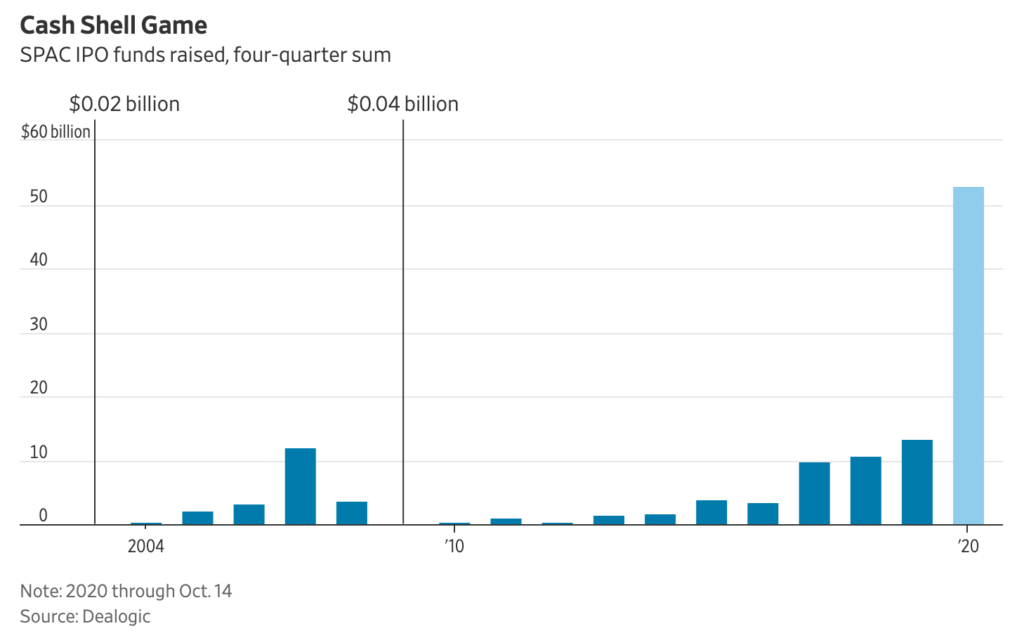

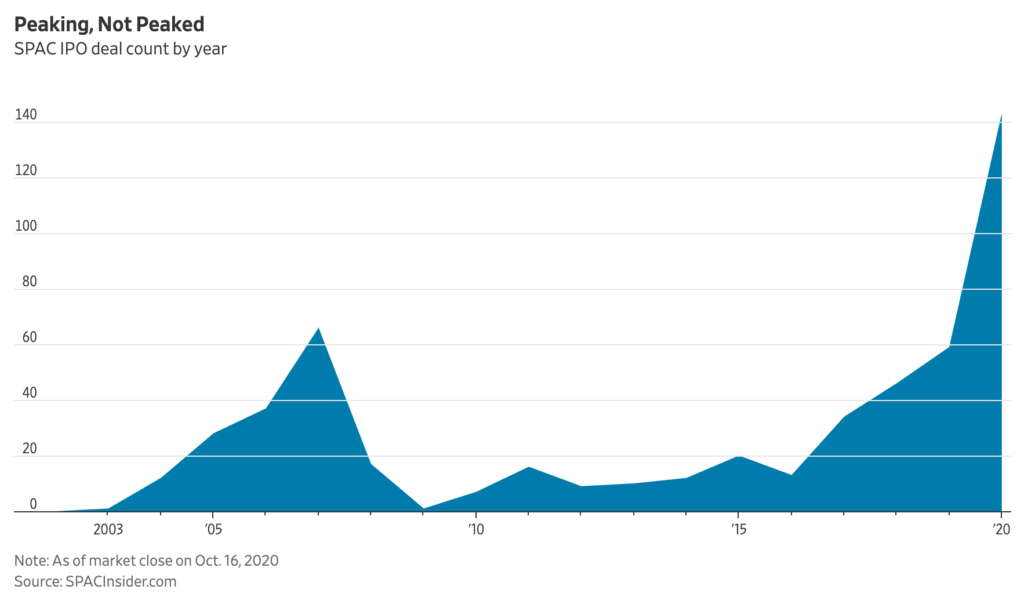

This year has seen an explosion in SPACs. So far, they’ve raised $53 million through 143 deals, compared to just $13.5 million through 59 deals last year, which was then the record. The last SPAC explosion was in 2007, leading many to suggest we’re in the land of bubbles.

However, the Wall Street Journal’s James Mackintosh had this to say, after explaining how SPACs make him worry about the market:

Low interest rates help explain some of the growth of SPACs, because they make the downside more palatable. In the worst case—barring fraud—investors can get back almost all their money. In normal times, that money might have earned more interest elsewhere, but with rates at zero, the opportunity cost of a SPAC is low. There should be more demand for them, all else equal.

Last week, Churchill Capital Corp., a SPAC, agreed to merge with e-learning and talent leader Skillsoft in a deal with a transaction value of about $1.3 billion.

The combined entity will then acquire Global Knowledge Training, an IT and professional skills company, for $233 million. The new entity will be called Skillsoft and trade on the New York Stock Exchange.

This wasn’t the only big move from the past week.

The Salt Lake City-based talent acquisition platform HireVue augmented its intelligent assessment capabilities with an acquisition of AllyO and its AI/ML bot capabilities. The deal is valued between $50 million and $100 million, according to PE Hub.

What’s this all about? For that you’ll have to read Brian Sommer’s take at Diginomica.

Our take: This is just the first of a lot more consolidation and shuffling in Work Tech. The rumor mill is going into overdrive right now, and SPACs are likely here to stay.

If you want to chat about the rumor mill though, do let us know.