Stay positive. We think next year is going to be a blockbuster year for Work Tech.

When you look back at 2020, sales of everything but communication, collaboration, and wellness solutions basically came to a halt between March and May. Activity began to rebound after that. Many Work Tech companies that we’ve spoken with reported all-time record sales months since June, including in the Talent Acquisition space that took such a hard hit at the end of Q1.

We’re seeing lots of evidence of pent-up demand in conversations we’re having with customers and prospects, as well as the market research data coming in. Our friend Rhonda Marcucci from A. J. Gallagher said a few weeks ago at the William Blair Benefits Technology Conference that 69% of the companies she’s surveyed intended to increase their HR tech spend (not just benefits), which is actually a bit of an increase from the past few years. We trust her data. She has maybe the best Work Tech vendor database in the industry.

We’re not out of the woods with COVID-19. The disruption to life and work could easily extend through all of 2021. But the activity we’re seeing and the conversations we’re having indicate an improving Work Tech buying market.

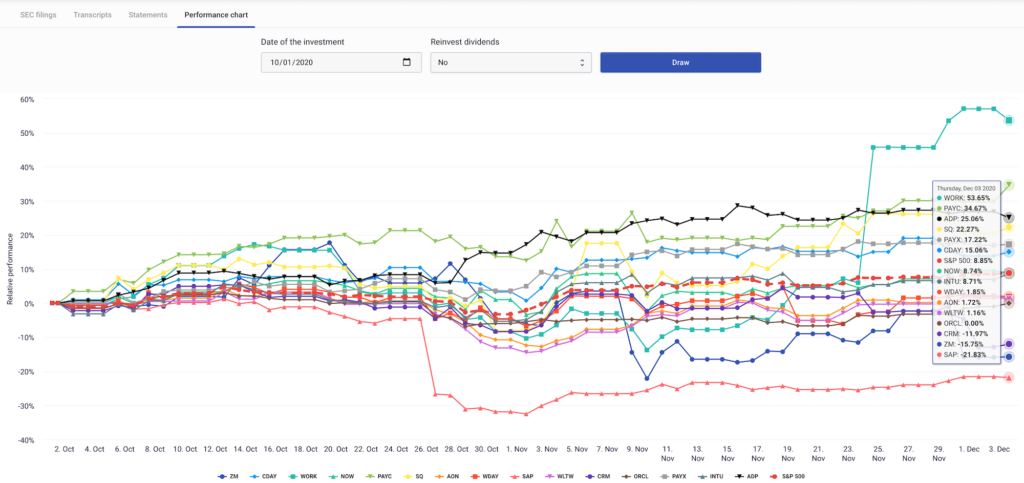

Evidence of that can be seen in our Work Tech Index. This year we’ve been tracking the 25 largest public Work Tech companies to better understand trends in the market. Of our top brands, only 3 have had poor share price performance since October 1 as of this morning — SAP (down over 22%), Zoom (down over 13%), and Salesforce (down over 11%).

Slack, Paychex, and ADP top the list, returning over 54%, 31%, and 24%, respectively, since October 1. Slack, of course, has had a tremendous few weeks since rumors began of a Salesforce acquisition for a $27.7 billion valuation.

Of course, COVID cases are surging right now, which isn’t a good look heading into the holidays. Yet consumer spending is high, jobless claims this week were lower than forecast, and for most of the Work Tech Index, analyst ratings are still at solid buys.

So, let’s finish this year strong, but also be optimistic about what the future holds. There are better days ahead.