Welcome to a new series dedicated to the financial and economic side of work tech. We’ll explore the top stories as well as the bottom ones. As a financial professional covering work tech (HR tech, HCM, whatever), you’re looking for in-depth analysis and an insider’s take on the companies you care about.

Here’s a taste of what’s to come.

The big story this morning is the damage control from the Fed’s minutes released yesterday from its meeting in December. Markets reacted strongly. As Reuters noted yesterday, “The Nasdaq‘s 3% drop on Wednesday was its biggest one-day percentage decline since last February and the S&P 500 fell the most since Nov. 26, when news of the Omicron variant first hit global markets.“

How did work tech respond?

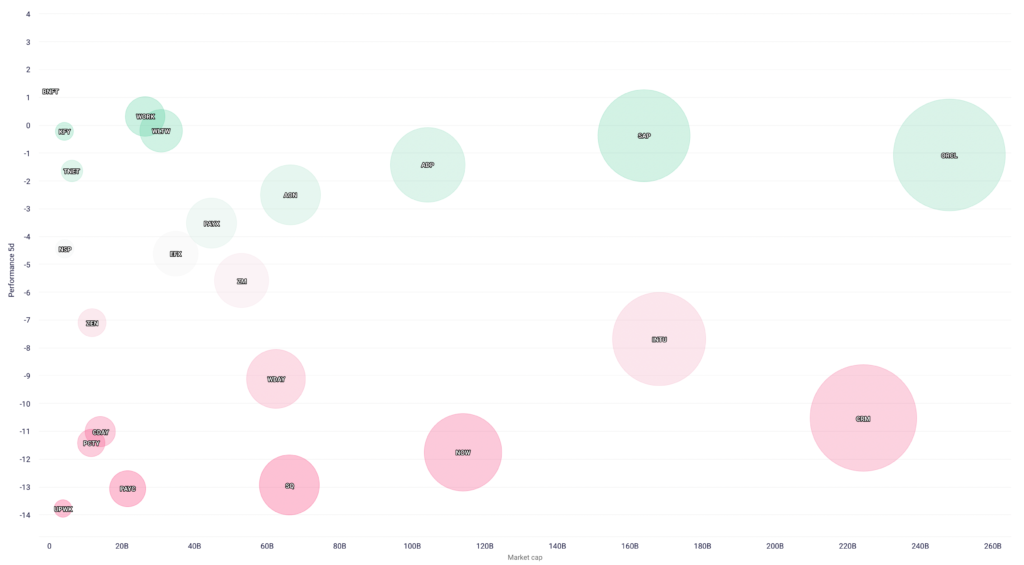

Over the last few days, as investors considered the inevitable rate increase, many public work tech companies took a nose dive, as you can see in this visual.

Upwork, some of the Pays, Block (formerly Square), and Salesforce took a beating.

This isn’t all that surprising considering the leverage of these particular firms. As rates rise, a heavily indebted capital structure becomes, well, a liability.

A few outliers from this list include ADP and NSP, but the others fit the bill.

We’ll keep updating this post as news develops today and this week.

Stay tuned for more.