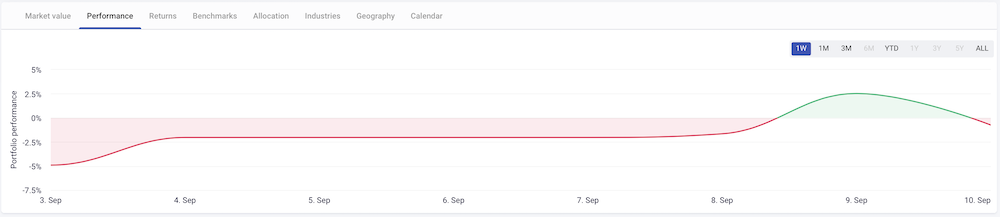

Work tech suffered a loss of -0.75% this week as of Friday morning, according to The Starr Conspiracy’s analysis of the top 25 public work tech companies.

This analysis is part of a project we call the Work Tech Index, where we’ve been analyzing work tech’s public equities since earlier this year.

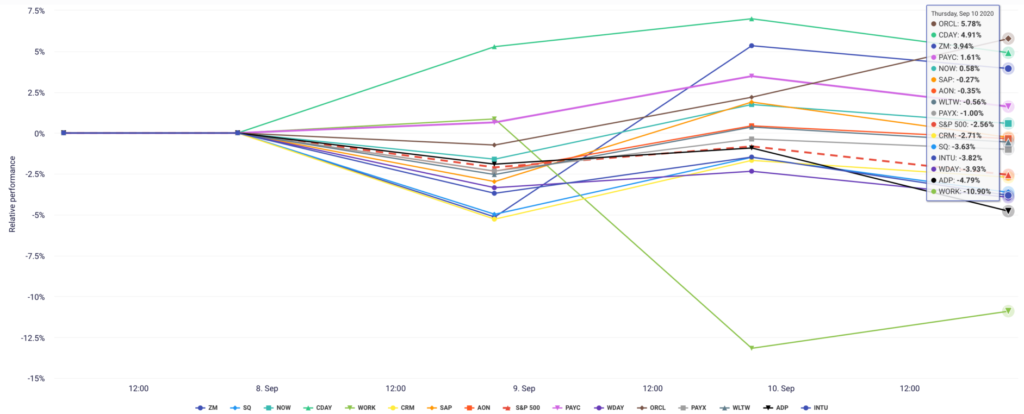

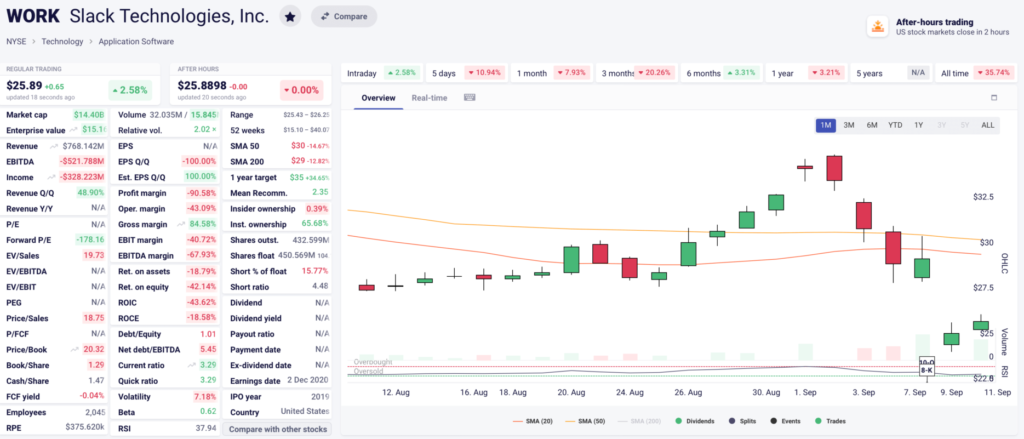

Some fared better than others. Slack (WORK), for example, crapped out at -10.90% on the week. Why so bad? Let’s take a closer look.

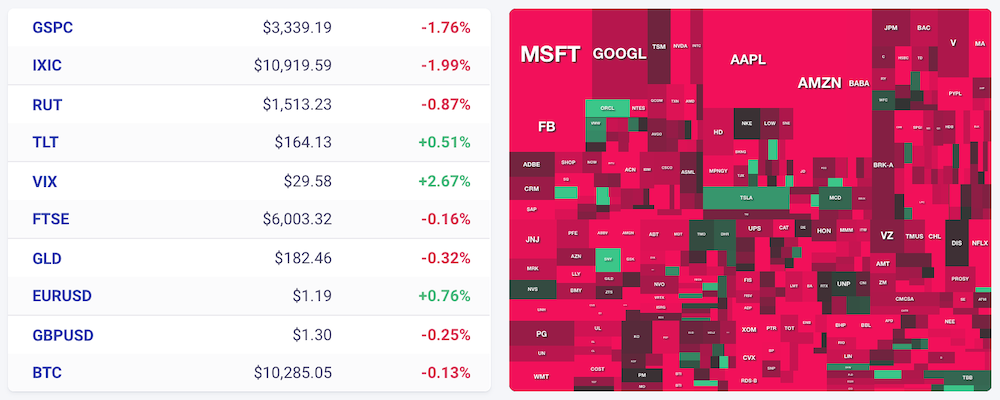

This week has been tough for markets overall, with big swings on big news. AstraZeneca paused a major COVID vaccine trial, Congress failed to deliver on a stimulus package, Trump’s headlines continue, and major fires plague the US West Coast.

2020, amirite?

Overall, the S&P 500 is down -2.56% this week, with the tech-heavy Nasdaq down -3.48%. Here’s how markets closed Thursday… Bloody Thursday.

So, how about work tech?

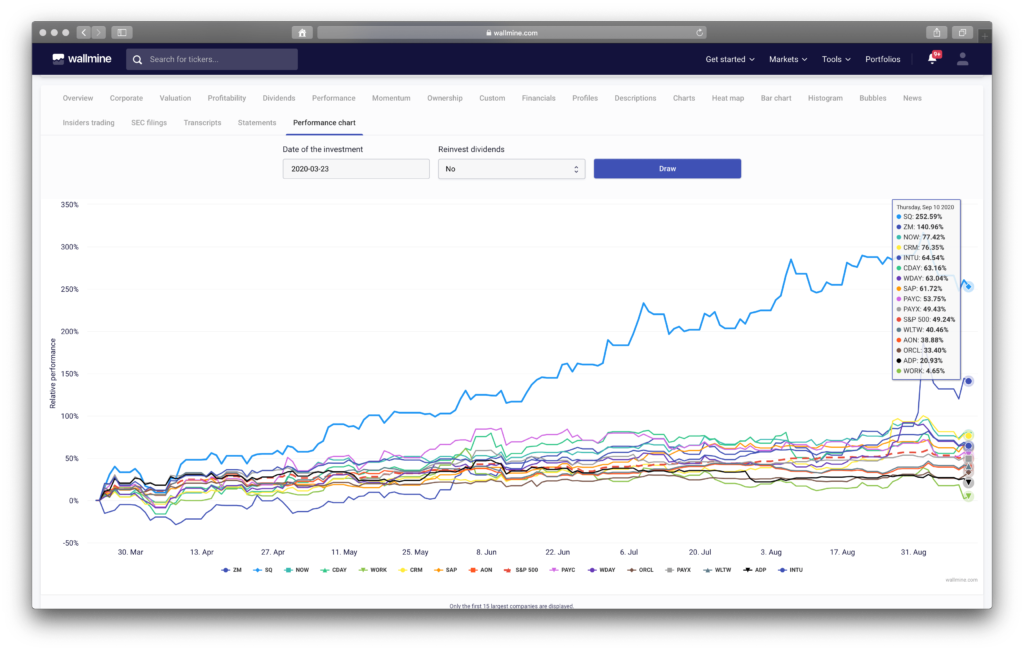

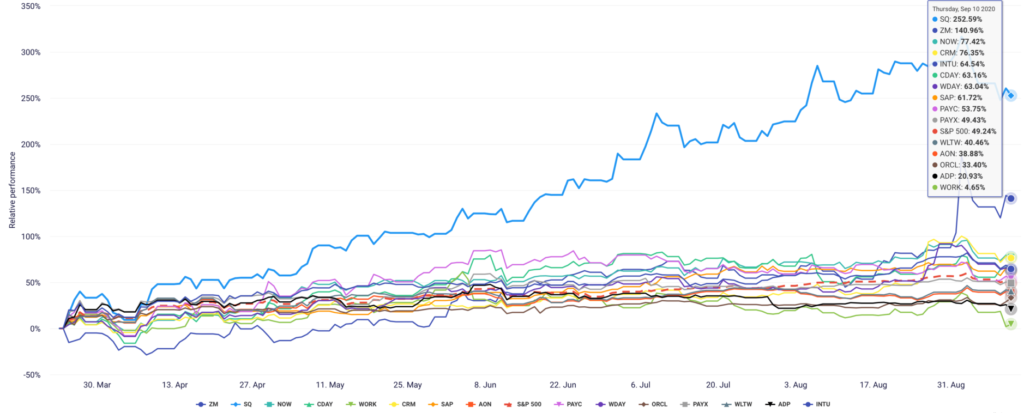

Since March 23 lows, work tech has exploded in growth, mainly because of employees suddenly working from home and relying on the tools work tech can offer them.

Square (SQ) and Zoom (ZM) top the list, returning 252.59% and 140.96%, respectively, since March 23.

ADP and Slack (WORK) bottom the list with 20.93% and 4.65% returns, respectively.

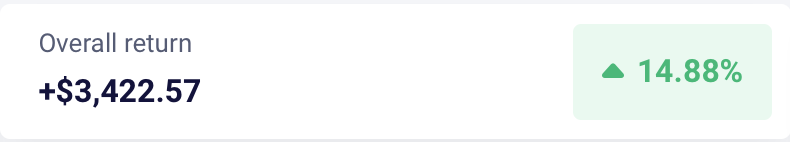

Since June, when we began building the portfolio, the Work Tech Index has returned a promising 14.88% compared to the S&P 500’s 11.70%.

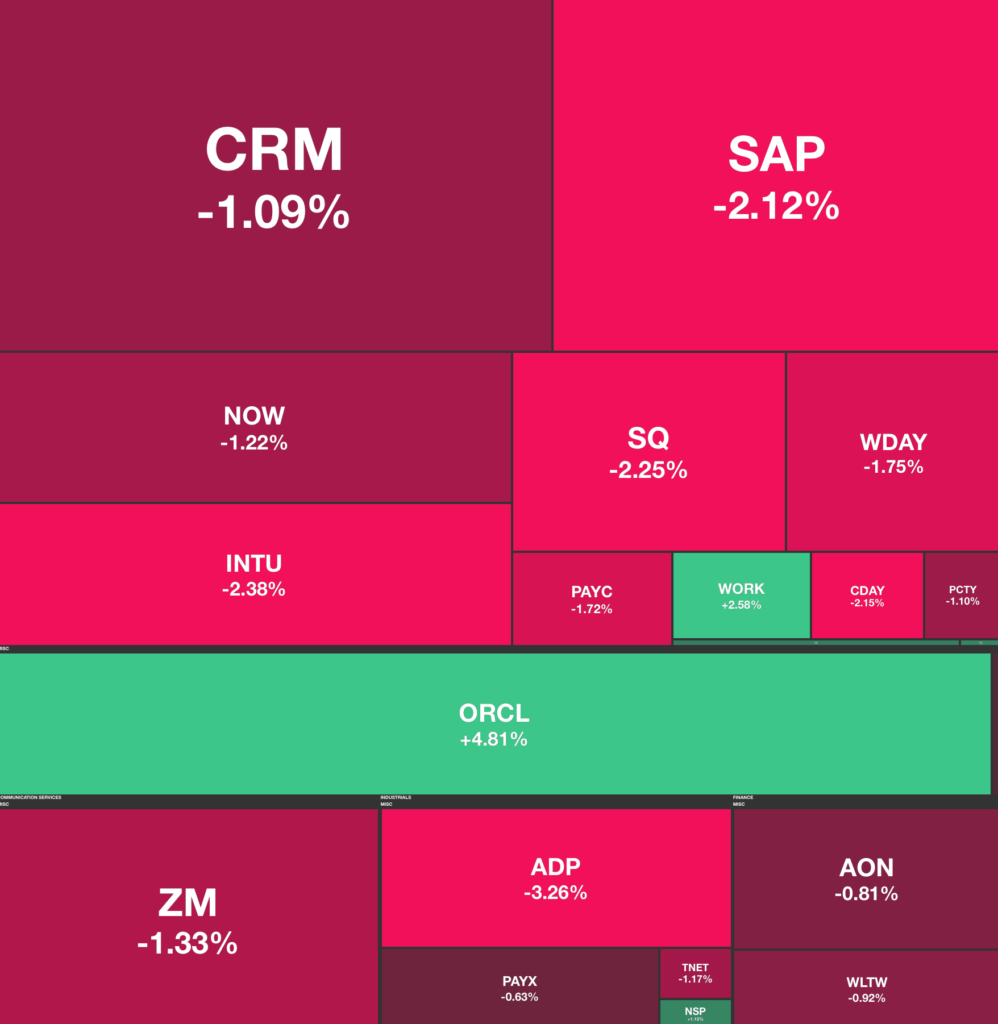

Yet looking at the work tech heat map from yesterday’s session gives some more detail.

First of all, note Oracle’s (ORCL) great day at 4.81%. Oracle surged after announcing its quarterly earnings report, despite losing out on the government’s JEDI contract to Microsoft (MSFT). Short story: Oracle beat revenue expectations as many organizations signed up for cloud services for remote work. As Reuters notes, “Total revenue rose 1.6% to $9.37 billion, beating analysts’ average estimate of $9.19 billion.” They’re also in talks to buy TikTok, but that’s another story…

Just above that big green bar, however, you can see Slack in green, returning 2.58% on today’s tough session.

That’s in part due to its abysmal run this week, as investors sought to recover earlier losses. Here’s Reuters again: Slack’s “billing growth, a key indicator of future revenue, slowed in the second quarter and the workplace messenger app owner said it took a $11 million hit in the first half due to the COVID-19 related concessions.”

Two tidbits stand out on Slack’s disappointing performance this week and this year as a whole, despite the good day they had yesterday.

First, they’re no longer the poster child for WFH. Everyone thought that Slack was going to “kill email” and dominate the collaboration space (remember that full-page ad?). Yes, they have lots of users and even more integrations, but the proof is in the pudding.

Second, Microsoft Teams is out to eat their lunch. We’ve heard from a lot of brands about Teams’ meteoric rise, but will it continue?